The fiscal year ended March 31, 2018 concluded our 33rd year in business and our 31st year as a public company. Over those 33 years, Nicholas Financial has celebrated many milestones, marked countless accomplishments, experienced great success, and – most importantly - produced consistent returns for our shareholders.

The last several years, though, have been a real challenge, and our results have not been good. It is true that the last few years have been some of the most competitive in the history of our industry with more and more lenders entering the space offering lower rates and higher advances on customers with weaker credit. As a result, it has been more difficult to acquire new contracts on the terms we desire and the customer parameters we want.

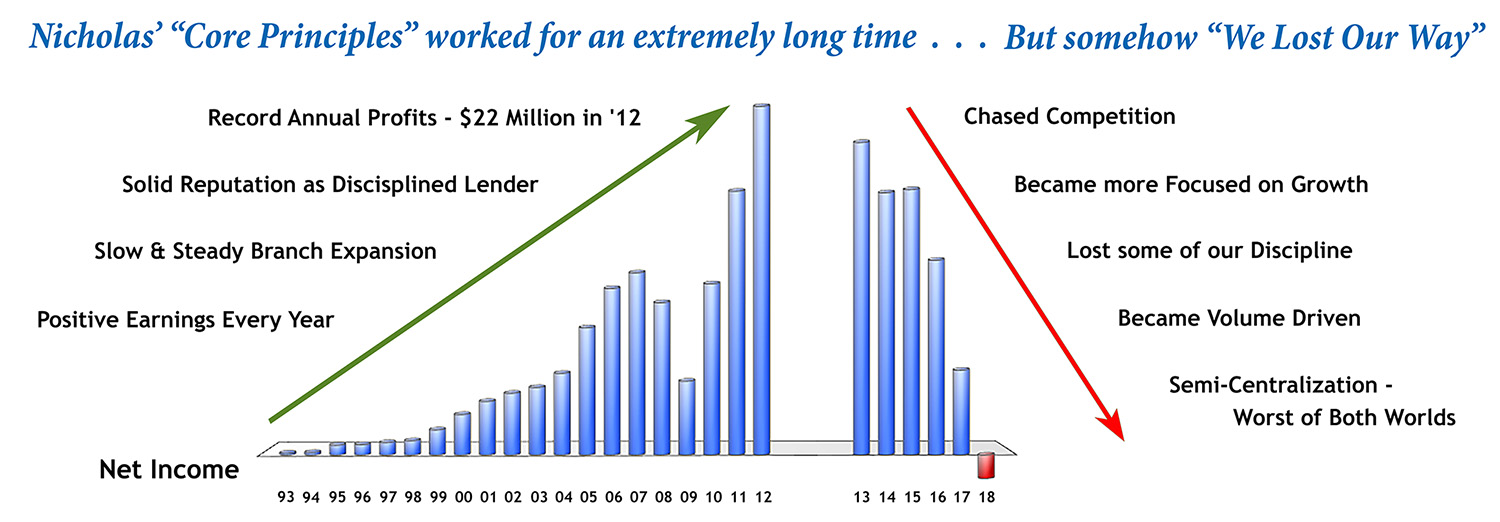

But this is the not first time our industry has experienced a peak in the competitive cycle (and it won’t be the last). We had similar situations in the mid to late 1990’s, again in the early 2000’s and more recently in 2008 and 2009. The difference during those earlier cycles and this one is that Nicholas managed to continue to produce exceptional results, whereas these last few years have been the worst earnings periods in the history of the Company. So, what is different now as opposed to then?

Doug Marohn

President & CEO

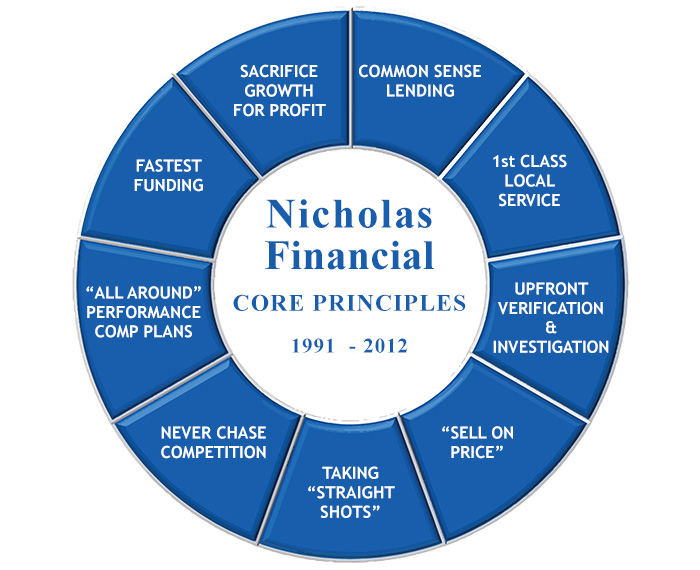

To answer that, it is important to look at the core principles on which Nicholas Financial was originally founded. These are the exact reasons why we were so successful for so long. First and foremost, we began as a company that offered true “common sense” lending in the subprime space. We focused on financing primary transportation to and from work for the subprime customer. We did not finance luxury vehicles, second cars or weekend / recreational units. We only financed basic transportation for our customers, and as such we focused on modest amounts financed over shorter terms and with reasonable payments.

We also remained extremely disciplined in our decision making and underwriting processes. We always conducted upfront investigations and verifications so that we were dealing with facts when making a lending decision. We also interviewed most customers upfront prior to making a decision, allowing us to better understand the overall credit and financial aspects of that customer. This allowed us to structure a deal that truly matched that customer’s situation and also gave comfort to the dealer that they could count on getting funded quickly, since everything was already verified and confirmed on our end.

We understood what a subprime deal was and - more importantly what was not. We knew that a true subprime deal did not warrant a larger dollar amount financed and advance to the dealer, a lower APR, a smaller discount, nor a longer term. We understood the need to offset the inherent risk of this business with high enough yields to cover expenses and losses. We also understood the benefit of shorter-term deals that allow the customer to pay off or trade out of their vehicles in a timely fashion.

We operated a branch-based business model that empowered our employees to perform and rewarded them for profitable operations. We did not just incentivize our offices based on new loan volume but always included delinquency and charge-off parameters as a check and balance. The overarching incentive plan for our Branch Managers was a Quarterly ROA plan that rewarded the managers more aggressively the higher the ROA they achieved.

We never lost sight of the importance of excellent service to both our dealers and our borrowing customers. Our branch-based model gave us a unique advantage over our competition in this respect. This advantage was evident in that we would rarely be beat in terms of service. Our Branch Managers were not just reps, but true professionals with full lending authority. Our branches handled all aspects of the process from underwriting and funding through the servicing of the loan.

Our approach allowed us to be the most flexible in terms of approving deals that made sense. We could fund new contracts for dealers more quickly than anyone in the business (and would often hand deliver proceeds to the dealer in person).

Our customers had a local branch that they could visit to take care of business. In short, it was our relationships with both our dealer partners and borrowing customers that set us apart.

Finally, we never – never – chased competition. When the cycles would turn and competition got overly aggressive, we chose to sacrifice growth for profit. We continued to buy deals under our terms. If that meant we got a lesser share of the business for the short term, then that was okay, because we knew it would pay off in the long term. We took the straight shots, but we left the bank shot for the other lenders.

And that worked for an extremely long time.

But somehow, shortly thereafter, we lost our way.

After a few years of leveling off in 2013 through 2015, we began to feel the pressure of increasing competition and a more difficult environment. During this cycle we did not stay true to our roots and we began to chase competition. We allowed ourselves to stretch on advance, yield, term and credit quality, all for the sake of maintaining volume and holding on to market share.

The inadvertent result was that we became more focused on volume and growth, and we were not as focused on maintaining our discipline. We produced larger deals with lower yields and longer exposure. The unintended consequence was rising delinquency and mounting losses, which drove down our earnings. The Company and prior management tried several things to mitigate what had become an avalanche of losses and provision expense.

The Company created additional lending tiers, brought in the use of alternative data, tried to create a more scorecard-driven underwriting model, attempted to centralize funding, and briefly took servicing out of the field only to return it to the branches a few months later.

Unfortunately, these new efforts and initiatives did not have the desired impact as we increased expenses by adding additional layers, decreased efficiency by adding additional processes and drastically lowered business production. The result was a loss of the brand identity Nicholas had established in the field over the long history of the Company. We also continued to see margins deteriorate by way of lowered APR’s and discounts, larger deals and longer monthly terms.

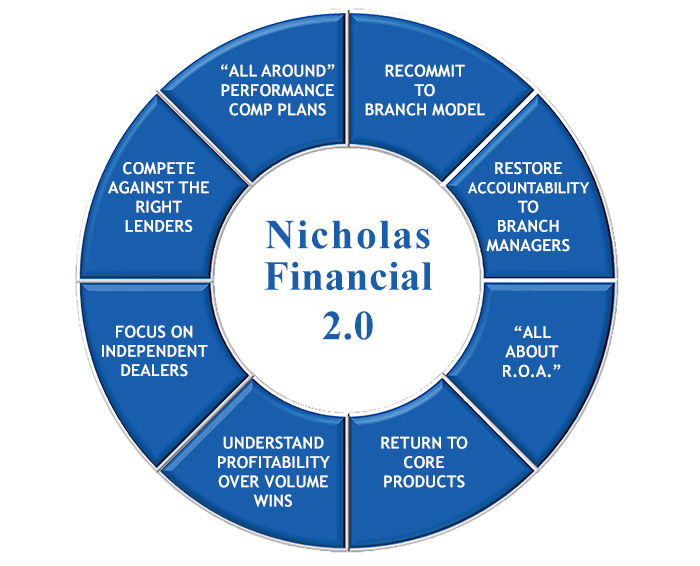

Since my return to the Company on December 12, 2017, however, we at Nicholas Financial have recommitted ourselves to the core principles that made us so successful for all of those years.

We are indeed a branch-based company and are committed to remaining so. We understand and accept the increased overhead that goes with that model, but we are also committed to structuring and pricing deals sufficiently to mitigate that increased overhead.

We are also hyper focused on providing that best-in-class service to dealers and customers that the branch model allows us to offer. This service will help us not only regain our share of the market but will also help us control our delinquency and losses better.

As we recommit to our branch model, we also recommit to the niche market we serve. Anyone who works at Nicholas hears me say this maybe 10 to 15 (or more) times a day. We finance primary transportation to and from work for the subprime borrower.

This means lower dollar deals with appropriate yield on shorter terms. This allows us to mitigate the risks inherent with true subprime loans by way of covering the losses with enough margin to produce a solid return. It also allows the customer to re-establish their credit and payoff or trade-out of their loan more quickly.

In order to focus on the vehicles and customer credit profiles that support this niche, we are also recommitted to servicing primarily the local independent automobile dealer. We can and will still offer our product to the franchise dealership, but our core dealer is the local independently owned used car store. This approach also positions us well from a competitive perspective.

The other lenders that typically service independent dealerships for subprime customers also tend to have pricing more in line with Nicholas’ program. That means we are no longer competing against lenders with materially lower rates, smaller acquisition fees, and longer terms. This helps to level the pricing playing field, and when the pricing playing field is level, we can then compete on all those things that our branch-based model gives us the upper hand.

We have a branch office in every market we serve, with a Branch Manager empowered to make decisions and who is compensated for the entirety of the operations. In short, the competition becomes about service and relationships, and when it does we rarely get beat.

This is more than just a theory. It is also more than a look back at years gone by that are not relevant to the here and now. In the short time since I rejoined the Company, we have not only been able to focus on these items – we have executed these strategies.

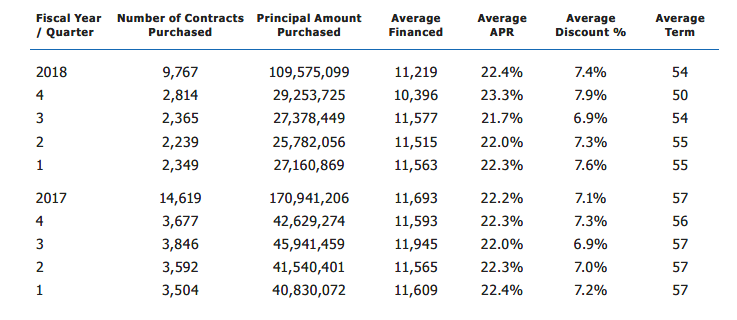

In the 4th Quarter ended March 31, 2018, we were able to reduce the average amount financed by as much as $1,500. We also increased the average interest rate by over 150 basis points and the average discount by 100 basis points. We did this without materially changing the average age or mileage on the vehicles securing our accounts and without materially changing the core credit profile of the customers we financed.

Now that we have gotten back to our core product, we can begin focusing on marketing our program, our product and the Nicholas brand more consistently. The intention is to not only buy the right deals with the right structures, but to buy at the quantity levels that help us grow when possible.

That said we will remain more focused on profits than on growth. For example, we had over $325 MIL in net receivables at the end of this fiscal year, but we had our worst year in terms of Net Income/Loss in the history of Nicholas. The last time Nicholas Financial made $22 MIL was when our net portfolio was about $240 MIL (in Fiscal Year 2012). We are perfectly content liquidating our portfolio down in terms of dollar size if that is all that market conditions will allow, as long as we are able to convert that portfolio to higher yielding deals that perform with fewer losses and produce better returns.

We still have a long way to go and a lot of work to do. Although we have materially reduced our delinquency and have gotten control of our losses in the 4th Quarter of Fiscal Year 2018, both of those metrics are nowhere near where we want them.

We will continue to evaluate our operations and make changes where necessary to continue to improve the servicing of our accounts while we continue to improve the parameters of our new purchases. We also still face the very real challenge of continued competition that exists in the market place. The main difference now is we are not allowing that competition to dictate the way we do business. It is no longer about them. It is about us.

I cannot express how excited I am to be back on the Nicholas Financial Team, and how humbled I am to be this Company’s CEO and President. My pledge to each and every shareholder, employee, dealer partner, borrowing customer and vendor is to help return Nicholas Financial to the consistent, secure and reliable company we have been known to be for so long. Now more than ever, we are focused on our model and we are committed to our business plan.

To all of you who have invested in Nicholas, thank you for your support and continued faith in our Company. On behalf of our Board of Directors, our management team and all our employees, we thank you for the confidence with which you have entrusted us.

Doug Marohn

President & Chief Executive Officer

June, 2018