If what got you here could get you there, you would already be there!"

- Dave Anderson from Learn to Lead

The fiscal year ended March 31, 2021 marked our 36th year in business and our 34th year as a public company. After several difficult years we were pleased to finally report a return to profitability at the end of Fiscal Year 2020 and this year we are even more excited to announce very robust earnings of $10.9MM in pre-tax income. This represents the highest earnings reported by the Company in five years and a year-over-year increase of $8.7 MM (for an increase of nearly 400%). The success of this past year has been the culmination of many initiatives put into place three years ago and additional strategic moves made over the past 2 years, as well as the hard work and dedication put forth by our excellent employees every single day.

In addition to the solid earnings results, Nicholas also enjoys a very strong balance sheet. We believe we have over $30 MM in excess capital above and beyond what it takes and has taken to generate these earnings. Whereas we always prefer to put any and all capital to work for us through our core business of new loan generation and contract purchases, we refuse to force more than the market will allow while still maintaining our

Doug Marohn

President & CEO

underwriting discipline. We will continue to explore other ways to deploy that excess capital. Those alternative options include investing in additional technology, investing in training and development initiatives, seeking out potential portfolio acquisitions, finding other investments that look attractive, and continuing our efforts to repurchase shares of NICK stock while it is trading at a discount.

Three years ago, I wrote my first open Letter to Shareholders as the President and CEO of Nicholas Financial, Inc. At that time, NFI was in a vastly different position than the improving situation we enjoy today. We had some very challenging and unfavorable market and economic conditions working against us back then, but moreover we were suffering from self-inflicted damage brought on by straying from our proven business model and the strict discipline that made Nicholas so great for so long. That deviation from our core principles threatened our very existence as an organization. In my first letter I told a story for the future of NFI. A story of rededication to our core principles. A story of embracing our branch-based business model. A story of returning to highly disciplined underwriting with more prudent structures and pricing that are the foundation of improved portfolio performance and increased earnings. We called that story “Nicholas 2.0”. We spent the last three years working long and hard to make that story a reality. It is with great pride and happiness we report that “Nicholas 2.0” is alive and well, delivering the results we have promised.

Structure, Structure, Structure

The first thing we changed in 2018 was our approach to pricing and structuring the deals we booked. As the chart below confirms, we have been able to consistently procure deals with a lower amount financed (roughly $10,000 on average), shorter terms (less than 48 months on average), consistent APR (approximately 23% on average), as well as improved discount levels (about 7.5% on average) since the inception of our Nicholas 2.0 effort to the present day.

Key Performance Indicators (KPI's)

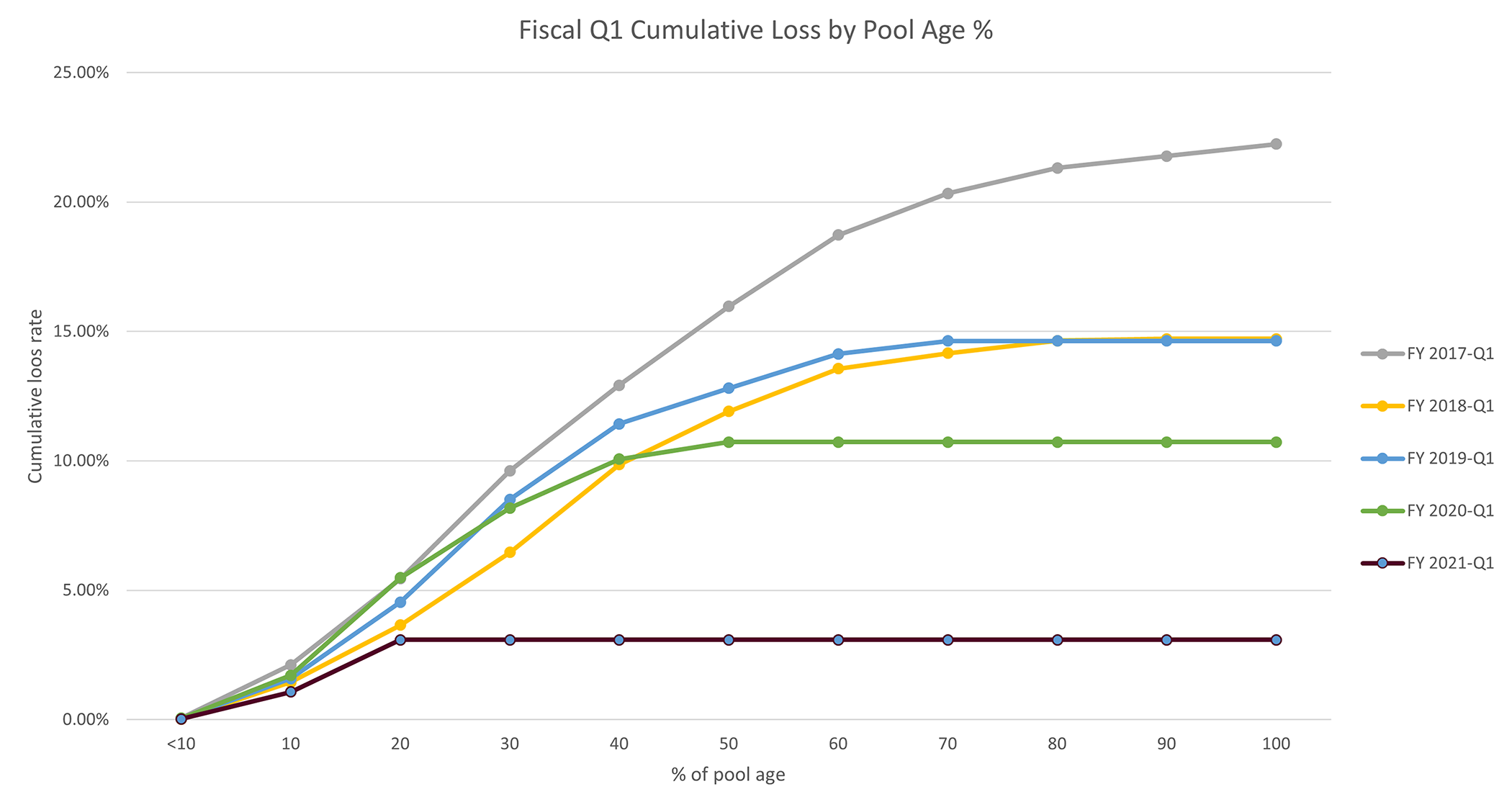

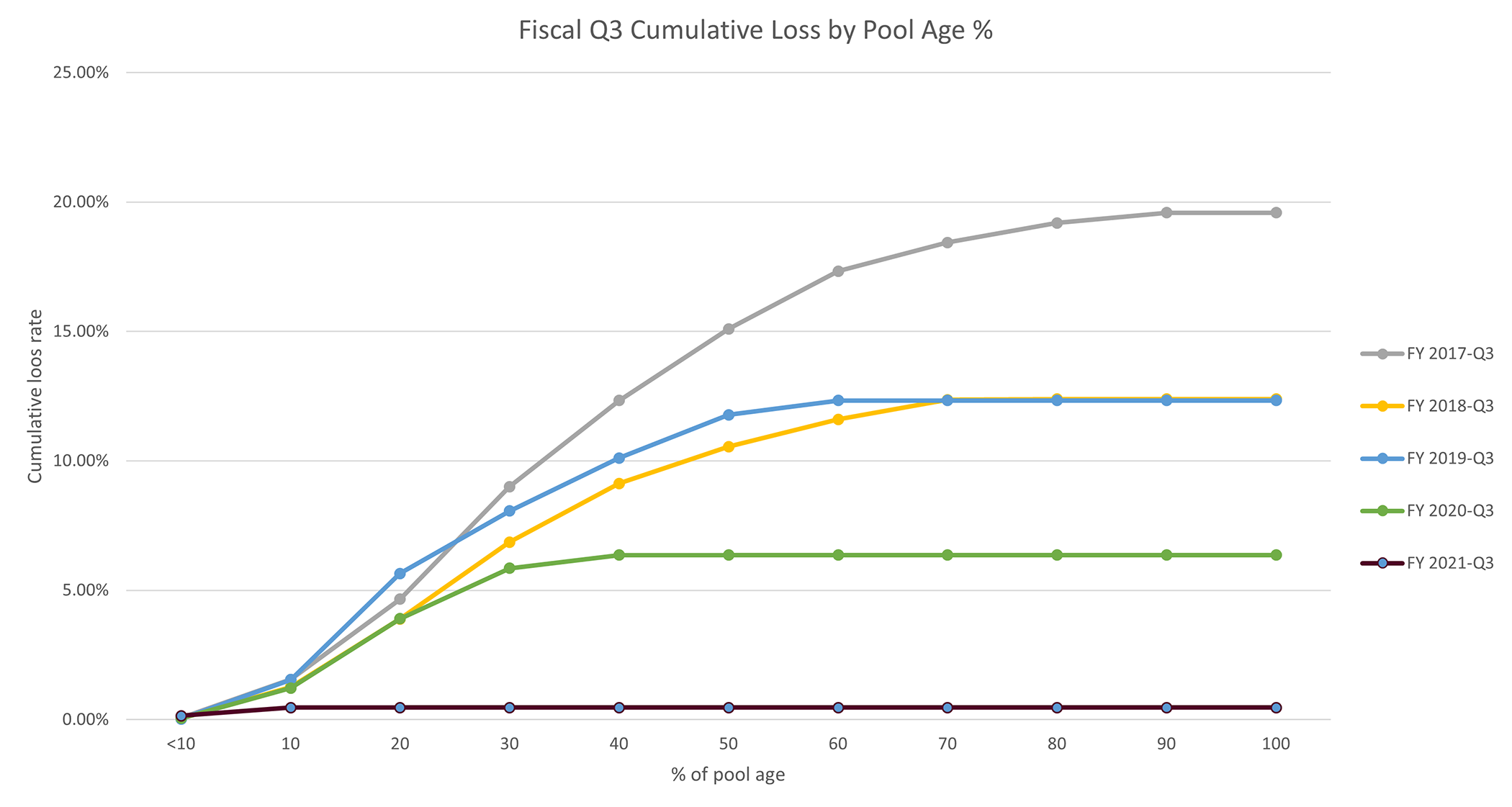

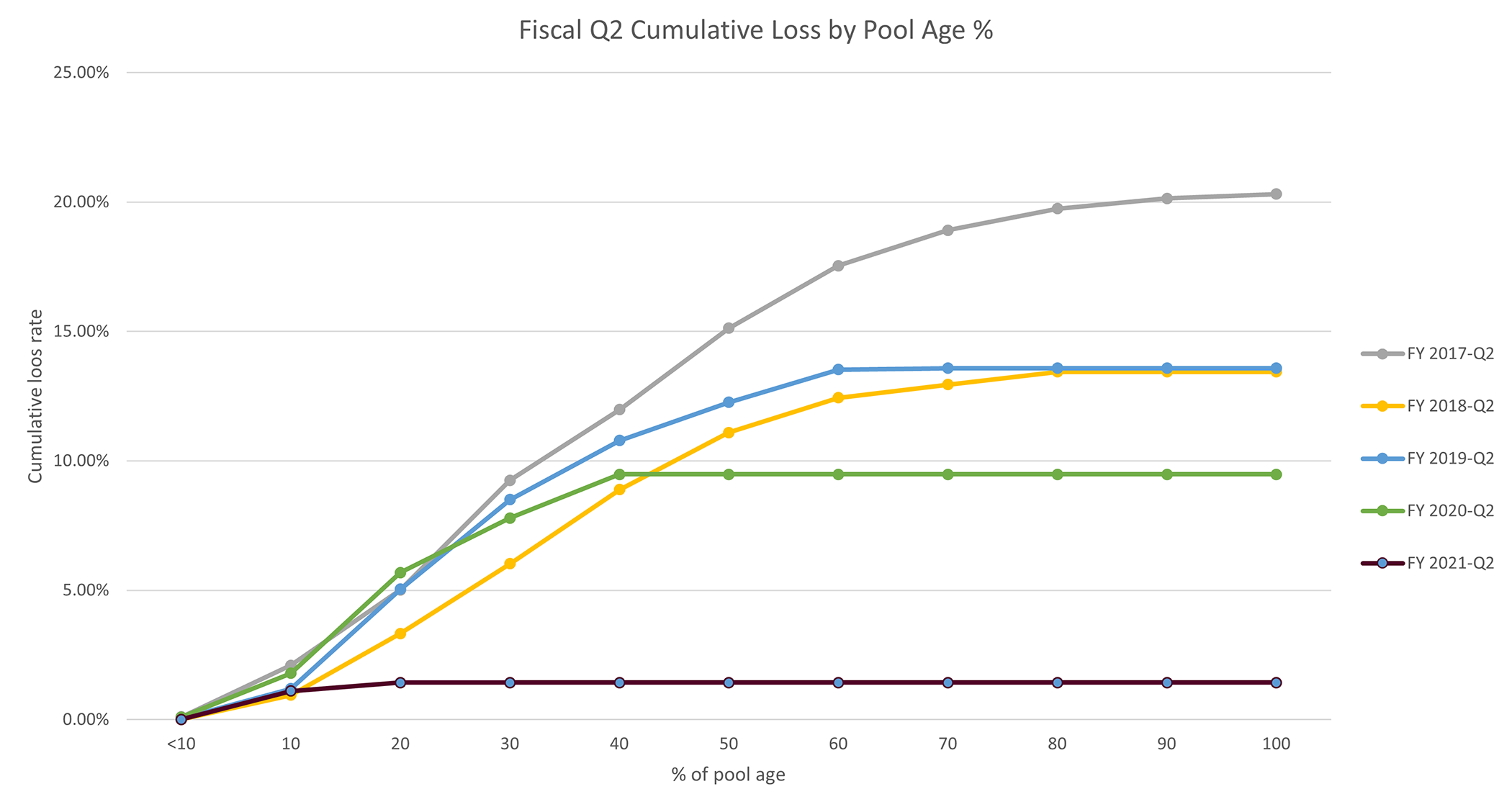

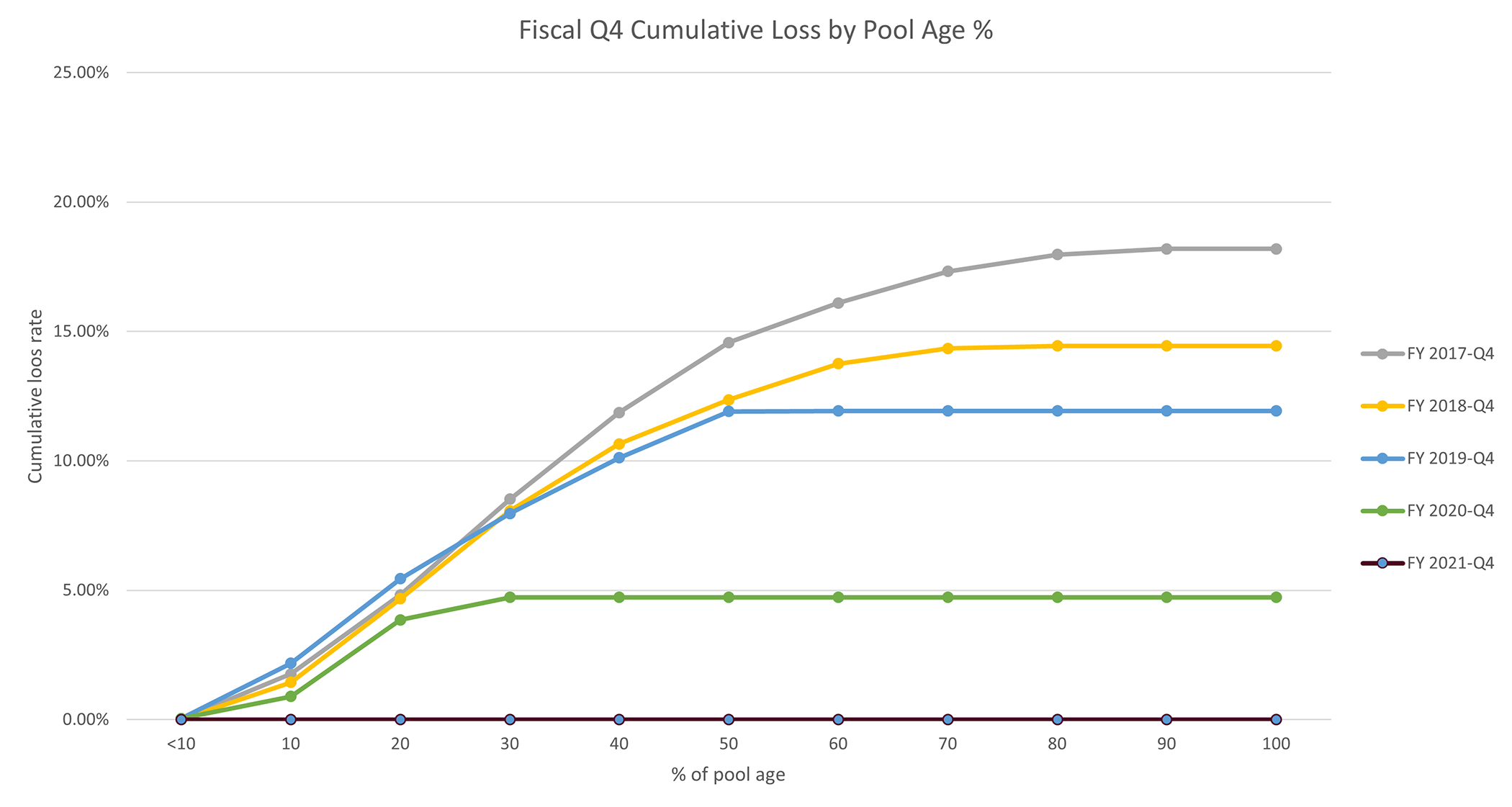

By structuring our new originations in this way, we have been able to successfully convert our overall portfolio away from the longer-term, higher-dollar, lower-yielding deals the Company had aggressively pursued between 2015 and 2017. This conversion helps our portfolio performance and overall profitability in many ways. Lower amounts financed allow for smaller dollar payments that are more affordable and therefore more easily met by our customers, even in times of hardship. Higher yields better protect the Company against the inherent risks associated with financing subprime credit on older, higher mileage vehicles. Shorter terms improve the relationship between principal balance liquidation and vehicle value depreciation. These aspects help improve on the front end by way of improved delinquency and lower repossession rates due to better affordability and shortened loan exposure time. Net losses are also reduced on the backend due to a lower balance as compared to vehicle value at the time of repossession and disposal. The Cumulative Loan Loss Ratio Timing Curves illustrate how these KPI’s combine with many other factors to help produce materially improved losses by pool vintage when comparing originations from 2015 through the end of Fiscal Year 2021.

Cumulative Loan Loss Ratio Timing Curves by Quarter

Local Lending Partner

Part of Nicholas 2.0 was a recommitment to the branch-based business model and all that goes with it. It has always been a given that the branch model is an expensive one. In order to offset the increased 0verhead, it is essential for origination yield to be maximized and losses must be controlled well. We have been able to successfully check both of those boxes but satisfying those two objectives alone are not enough. Even though we were slowly starting to post year over year increases in loan originations prior to the pandemic (and we met that goal in the Quarter ended March 31, 2021), we continue to experience a liquidating portfolio. We recognized this dilemma back in 2018 and implemented an initiative to bring our direct-to-consumer loan product (previously only available in our Florida offices) to all branch locations. We can now say we have that product supplementing our business in every established branch office and we are continuing to proliferate the Direct Loan product to our expansion locations.

At the end of Fiscal Year 2017, the Direct Loan Portfolio was a mere 1% of our overall portfolio. At the conclusion of Fiscal Year 2021 it was over 8.5%. Our Direct Loan originations in Fiscal Year 2017 totaled $8.7MM, but by the end of Fiscal Year 2021 we had grown that to over $14.1MM. In the first Quarter of Fiscal Year 2022, which ended June 30, 2021, we reported $5.7MM in direct loan originations and we expect that to continue to grow as we put more and more focus on the direct-to-consumer loan product as a part of our core operations.

Indirect originations through our local dealer partners drive our core customer acquisition but it is the direct-to-consumer loan that helps us retain and service our better performing customers. Often our customers graduate to lower cost options to finance their next vehicle as a result of re-establishing their credit with Nicholas. However, they typically have difficulty accessing credit for smaller dollar amounts for household repairs, minor emergencies, vacations, etc. That is where their relationship with Nicholas comes into play. We become their local lending partner, leveraging their good credit with us on their original car loan into providing them the ability to borrow between $500 and $15,000 (the average is about $4,000) for unexpected expenses or other needs. Rolling this product out to all of our established branch offices was a major endeavor that took a great deal of effort, but we are proud to report that this initiative is now a reality. We will continue to license our new expansion offices accordingly.

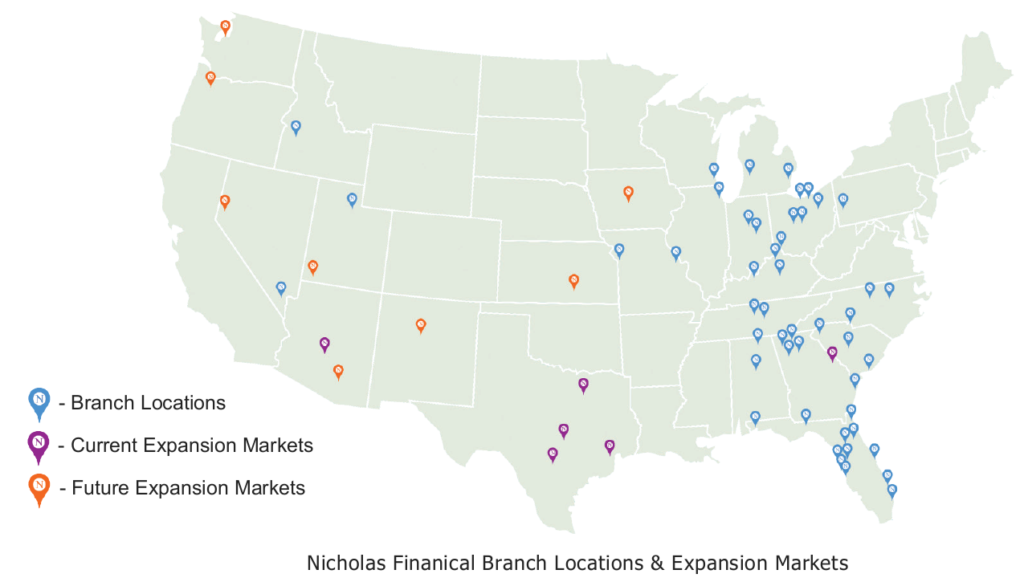

Expanding the Network

Over the last three years we have been forced to make some hard decisions in terms of a few select market exits, as well as more significant branch consolidations (taking markets with multiple branch locations and consolidating them into one or two offices). We had to do this to ensure the longevity of the Company while we were still working through the toxic portfolio originated under prior management. We went from 65 offices at the end of Fiscal Year 2017, to 42 offices at the start of Fiscal Year 2021. Our strategy was never to continue to shrink our network indefinitely. The longer-term intention was always to return to growth when possible and prudent. Entering Fiscal Year 2021 we recreated the Virtual Servicing Center (“VSC”) and initiated expansion efforts in several new markets. Although the market conditions for new originations have been somewhat depressed throughout the pandemic, we remained committed to returning to the expansion of our branch network. Therefore, when the market returns to a more robust business climate, we will be ready with more locations that are built, staffed, trained and ready to execute. By the end of Fiscal Year 2021 we were able to celebrate the openings of Las Vegas, NV, Columbia, SC, Salt Lake City, UT and Milwaukee, WI. In the first Quarter of Fiscal Year 2022, we have continued this trend with the opening of our newest office in Boise, ID.

Nicholas 3.0

The continued commitment to disciplined underwriting with appropriate risk-based pricing, the ongoing focus on proper deal structures and terms, the expansion of our direct-to-consumer loan product and the return to growing the branch network were the foundation blocks of what we previously referred to as “Nicholas 2.0”. As we stated earlier, we are very proud to have made Nicholas 2.0 not just a story but an ongoing strategy. It is now fully implemented and a reality.

Basically, we have accomplished what we set out to do a little over 3 years ago. We have managed to stabilize the Company, correct our operational mistakes, weather through a poorly performing portfolio and convert it back to a healthy one, and – most importantly – return to profitability and earnings growth. We are now once again a very nice regional finance company generating acceptable profits. This is something that we can do for many years to come – providing decent returns for shareholders while continuing to service our local dealer partners and borrowing customers. However, that is not where we want our resurgence to end. It is where we begin the next chapter of Nicholas Financial, Inc. That chapter is what we now call “Nicholas 3.0.”

Nicholas 3.0 is all about intentionally and specifically transforming our good company into a great one. Instead of being a monoline lender serving only the financing of a customer’s preowned vehicle purchase, we are focused on servicing nearly all the credit needs of our borrowers. Having established ourselves as a fairly well-known regional lender, primarily in the Southeastern and Midwestern markets, we are now intentionally turning our focus on growing our reach Nationwide – from coast to coast and border to border. We continue to invest in technology to supplement our more traditional processes and provide many more options to our dealers and customers in terms of how they do business with us. And finally, and maybe most importantly, we are laser focused on creating the premier place to work in this industry, starting with best-in-class onboarding, training and career path guidance. Of course, a lot of companies say they will execute all of these things, but how will we do it? Intentionally.

Product Line Diversification

The licensing of all our established branch locations to offer consumer loans in addition to our indirect sales finance contract purchases was a major undertaking and a great accomplishment. Now we are putting those licenses to work to better serve the needs of our customers, as well as to bring new customers to the Nicholas brand. Whether it be a secured side loan to an existing customer, a refinance of a customer’s existing car loan or a debt consolidation loan to a well-qualified new borrower, offering direct consumer loans allows us to truly be that local lending partner we strive to be.

To fully develop our direct consumer loan product and make it an even more significant part of our business, we are initiating several things. First, we have brought in a seasoned professional to lead, manage, and grow this product line. Second, we have added a dedicated Direct Loan Officer to every branch location. Third, we are in the process of developing our online and remote loan closing capabilities. Finally, we are creating several related loan programs for established customers. These efforts and more will allow us to continue to grow the direct-to-consumer loan business. We will be able to retain our customers and serve their needs as they improve their credit standing and graduate to more traditional financing for their auto purchase needs.

Going National

In 1985 Nicholas was born in Clearwater, Florida. For the next 13 years we expanded throughout the state of Florida. The following 15 years took us to many more states, mainly in the Southeast and Midwest. However, our product and our brand are not regional. They are designed to serve and support any dealer selling preowned vehicles and any customer needing financial assistance. We have already begun our “Western Expansion” with our new offices in Las Vegas, Salt Lake and Boise. We have stretched the network Northward with our new Milwaukee branch and now we are currently developing every major market in Texas, Arizona and New Mexico. Next up will be Oregon, Washington, Iowa and others. Our

plan is to be in every state over the next five years.

Digital Pivot

We have always embraced the “old school” approach of being the company that values the importance of face-to-face interactions and the integrity of a handshake. We will never abandon our commitment to being an organization rooted in excellent relationships and personalized service. That said, 2021 and beyond is a vastly different world than 1985. Over the last three years we have invested in several technological initiatives that include an improved loan management system, diversified payment platform options for our customers and much more. We will continue our focus on leveraging technological advancements. We are currently expanding our options for customers to make their payments by offering access through Google Pay and Apple Wallet. We are allowing for e-signatures on loan closings where permitted. We have invested heavily in fraud detection and mitigation to help us better avoid losses from those intent on defrauding the system. We are continuing to improve our loan origination products and software to better serve the auto dealership community as well as the individual borrower, so that both can submit applications and close loans real-time – at any time – from anywhere. The combination of being a local lending partner with a branch office in every market we serve coupled with our focus on technology and digital platforms sets us apart – and will continue to set us apart – from others who service this space.

Premier Place to Work

For all the good we have done over the decades we have been in business, we have failed miserably in terms of employee training and development. If a Branch Manager or District Manger was particularly skilled in this area, then we were fine. But in markets where those skills were not present, we did not fare as well. We had training manuals and outlines, but the execution of effective training practices has been sporadic at best. In order to truly be the best company we can be we need to immediately improve the training and development of our employees – and we are doing exactly that.

Not only have we brought on a Director of Training and Development to improve our efforts in this area, but we have also invested material resources to create a first-class environment focused on new hire orientation, specific skills training (collections, underwriting, funding, etc.), leadership development and career path planning. To that end we will soon open a new Central Business Operations hub in Charlotte, NC.

This state-of-the-art facility will host our high-tech training facility for in-person as well as remote learning and development. In addition, it will be home to our Virtual Servicing Center which supports our branch expansion efforts. Human Resources and Recruiting will call Charlotte home as they are vital to training and expansion. Existing field operations will be directed and supported from this new facility, as will our Direct Loan development and expansion efforts. Real Estate and Facilities Management will be housed there as well. Essentially, anything related to Employee Training, Operations and Business Development will be consolidated in our new Charlotte facility. All back-office (Accounting, Finance, IT, etc.) will remain in Clearwater. In creating this facility, we are investing in the future of the Company by investing in the development of our people. Placing this facility in Charlotte allows us to enjoy direct flights to anywhere and from anywhere. We will also have access to a very deep and diverse work force that has been the pride of the Charlotte area for quite some time. From the time a new employee joins NFI and throughout their career with our Company, we will be able to provide technical skills training and leadership development. The Customer Service Representative who starts with us today will be able to see their path to the position of Branch Manager and beyond tomorrow.

The past fiscal year was rewarding and exciting despite being very challenging and uncertain at times. All of the hard work, dedication and strategic effort we put forth resulted in very positive earnings and the improved overall health of Nicholas Financial, even in the face of a global pandemic and other adverse market conditions. As we move forward from all that 2020 threw at us, we also move onward and upward to a new and improved version of NFI. Nicholas 3.0 is here, but it is only the beginning.

Thank you to all of our investors, shareholders and stakeholders. We are grateful for your continued support. We are especially grateful for our excellent employees who work so hard to make Nicholas Financial better and better every day. I am so humble and proud to be a part of this great organization

Doug Marohn

President & Chief Executive Officer

July, 2021