The fiscal year ended March 31, 2020 marked our 35th year in business and our 33rd year as a public company. On this, our 35th Anniversary, we are ecstatic to report our return to profitability after posting a net loss the last two years and having previously posted five straight years of declining results. We previously called fiscal year 2019 an important and transformative year despite our net loss. At the conclusion of fiscal year 2020, we can see just how true that was. The securing of our long-term credit facility, the investment in our infrastructure, the continued focus on discipline in underwriting, the proliferation of our direct loan product and our openness to portfolio acquisitions all combined to create an environment that positioned us well for future success and profit. Now, in fiscal year 2020, those elements and more came together nicely to produce four quarters of positive earnings totaling $2.2 MM in pre-tax earnings for the year – a swing of $6.8 MM over our $4.6 MM pre-tax loss last year.

There is no doubt that the Covid-19 pandemic of 2020 had some impact on our 4th quarter and overall fiscal year results, and potentially will impact our fiscal year 2021 progress, as well.

Doug Marohn

President & CEO

However, the return to our core business model and strategy a little over two years ago positioned us well to weather the early storms associated with Covid-19. Although there was nothing that we could do about the virtual shutdown in business and new originations that took place in the second half of March 2020, our model and philosophy helped us successfully manage our portfolio.

As I have said since the first day I returned to Nicholas in December of 2017, we finance primary transportation to and from work for the subprime borrower. We do not finance luxury cars, second units or recreational vehicles, which are the first payments customers tend to skip in times of economic insecurity. We finance the main and often only vehicle in the household that is needed to get our customers to and from work. The amounts we finance are much lower than most of our competitors, and therefore the payments are materially lower, too. The combination of financing a need over a want and having that loan be very affordable comparatively, creates a situation in which our customer is able and willing to better maintain their account with us.

Our status as an essential business kept us open and operational throughout the pandemic, but our branch-based business model made us that much nimbler and more productive. If ever there was a time that proved our branch concept, it was the Covid-19 pandemic and its related shutdowns. Each market had varying degrees of stay-at-home orders and restrictions. The markets that were the most restrictive were able to funnel their customer servicing, underwriting and funding to the next closest branch without missing a beat. The fact that our branches are staffed with between three to five employees on average, allowed us to easily follow CDC guidelines on social distancing without impacting our ability to service our customers and dealers directly. The focus on our infrastructure and technological improvements in fiscal year 2019 allowed us to offer many more options for electronic payments and remote servicing. In short, we were well prepared and well positioned to handle the one-two punch Covid-19 threw at us with elevated unemployment and greatly reduced retail sales initially.

There is still a lot that is not known about the impact Covid-19 will have on the economy overall and our business specifically, but for now we are cautiously optimistic that we will get through to the other side relatively well. We entered the crisis with a solid liquidity position and excellent access to capital. We currently maintain both of these assets. Although business was and is down in terms of year over year production and actual versus budget, we have not (and the industry has not) experienced the complete shutdown that many expected when the pandemic began. Between the nature of our loan product and pricing, combined with stimulus relief money and enhanced unemployment benefits, our portfolio is performing at or better than expected in terms of delinquency control, cash collections and loss levels.

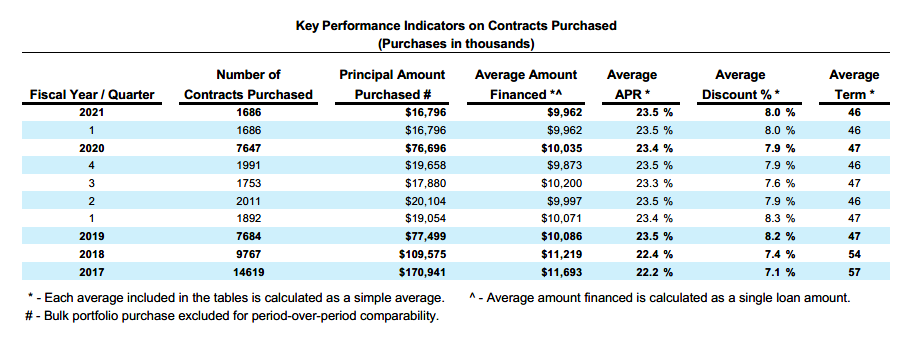

Key Performance Indicators (KPI's)

We did ask for and were granted special dispensation on the use of deferrals for those customers suffering a real hardship from Covid-19, and we did indeed put the use of those deferrals into practice. However, the extent to which we needed to rely on those deferrals was much lower than originally anticipated internally and as an industry. All of that bodes well for the future, but we will, of course, have to wait and see what happens to the economy as a whole. In the meantime, we can review all the other aspects of fiscal year 2020 that contributed to our results, as well as look forward towards fiscal year 2021 and beyond.

First and foremost, our recent success has been a direct result of our recommitment to common sense lending, conservative underwriting, and risk-based pricing that began over two years ago. Since January of 2018 we have systematically brought our Key Performance Indicators on new originations in line with what we know leads to better portfolio performance. We have consistently been able to produce an average loan size of approximately $10,000, an average APR of 23.5%, an average discount in the 8% range and an average term below 48 months. The chart (above) shows our ability to consistently maintain these KPI’s over the last 2 plus years.

This chart also shows that were able to steadily increase our production and gain increased market share throughout most of fiscal year 2020. After a slow start in the 1st quarter, we were able to out produce both the 2nd and 3rd quarters of fiscal year 2019 in fiscal year 2020. We were well on our way to doing so again in the 4th quarter, but the second half of March produced very little business and the ensuing shutdown prevented us from outproducing the previous year’s 4th quarter.

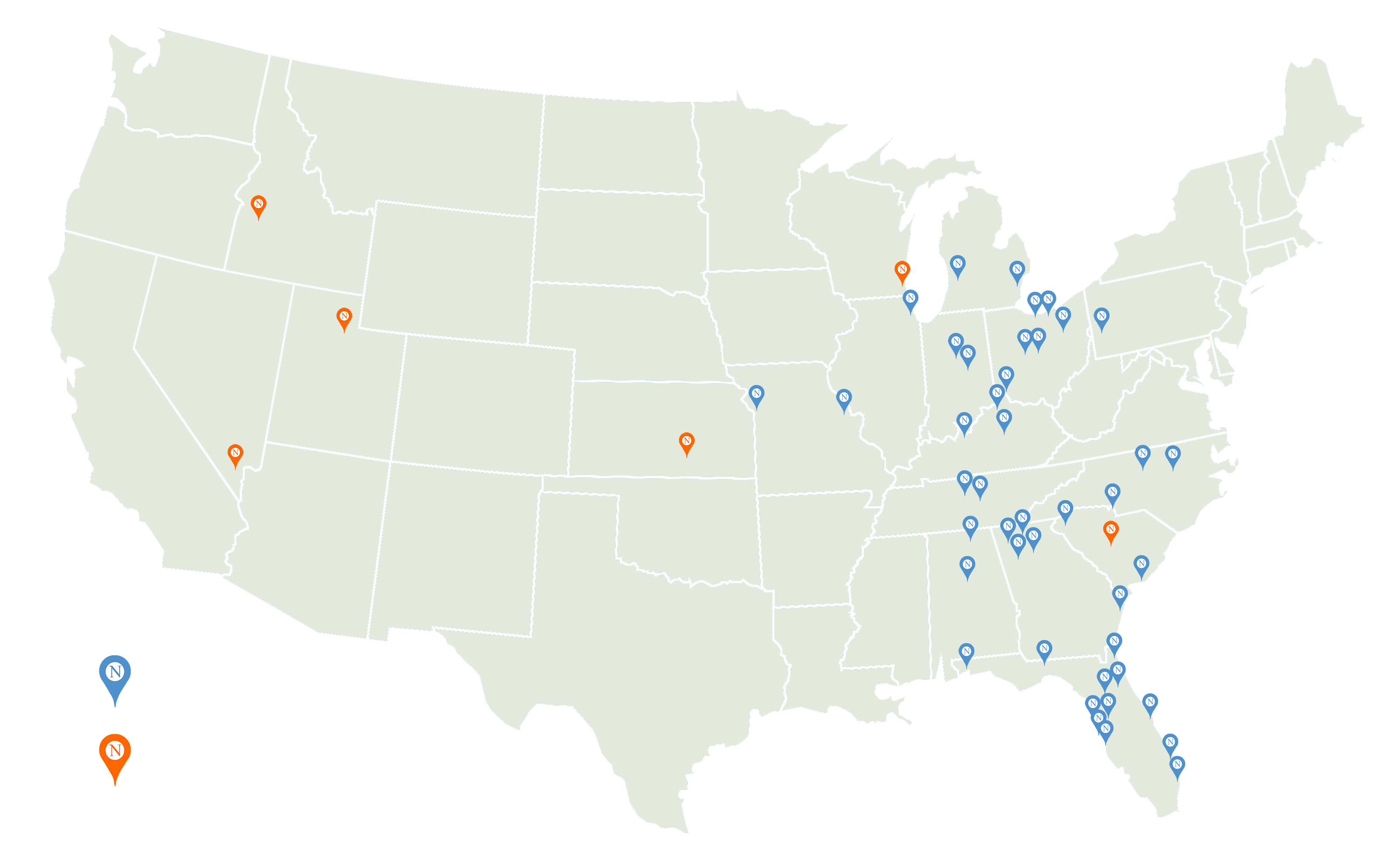

We were able to post these year-over-year production increases even though we have reduced our branch network. Last year we announced our exit from Dallas and Houston, Texas as well as Richmond and Virginia Beach, Virginia. We also consolidated multi-branch markets in Atlanta, Georgia, Raleigh, Charlotte and Greensboro, North Carolina. At the conclusion of fiscal year 2020 and into the start of fiscal year 2021, we announced a second wave of branch consolidations where we had multiple offices serving the same market. We believe we will be able to maintain and even increase volume production while materially reducing overhead expense in these consolidated markets.

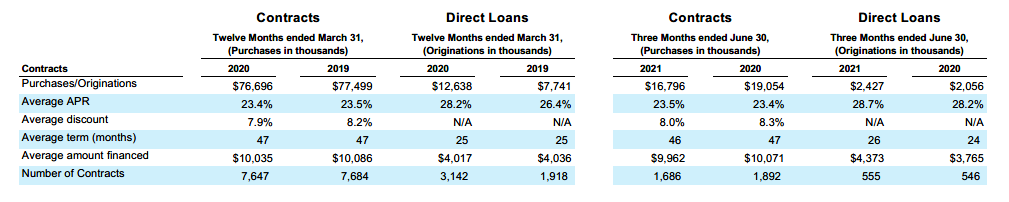

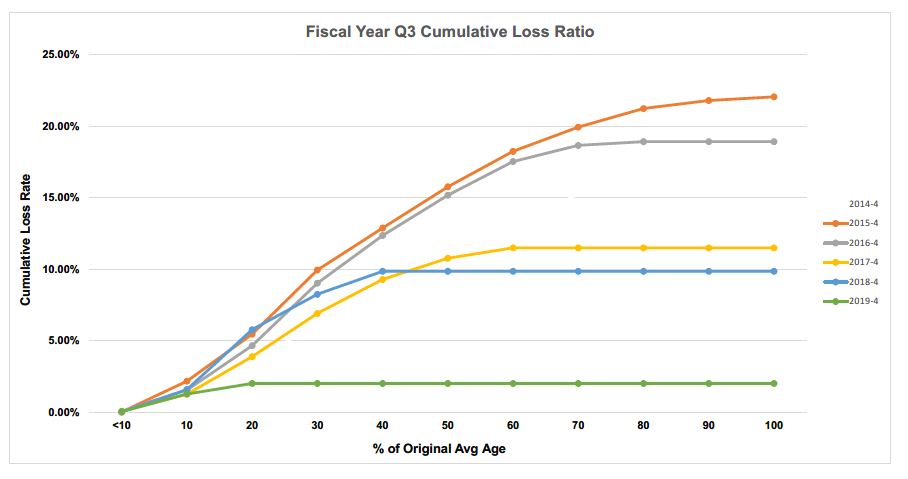

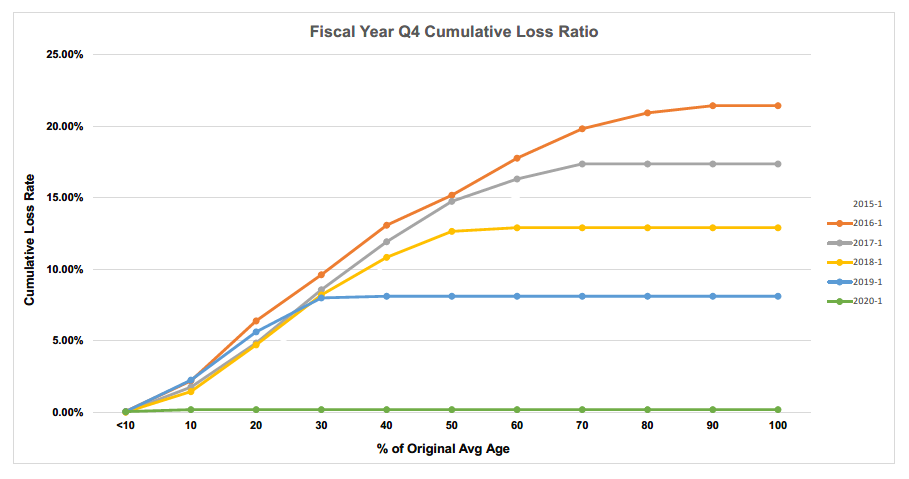

Year-over-Year Indirect and Direct Loan Performance

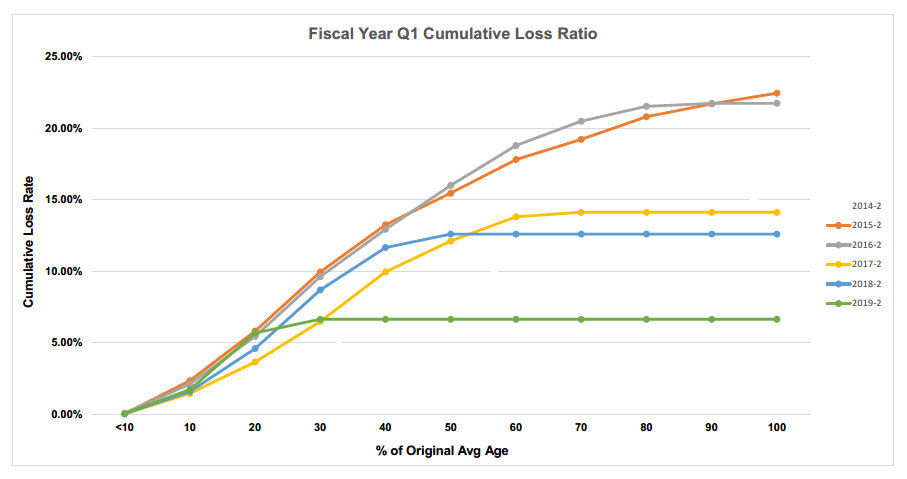

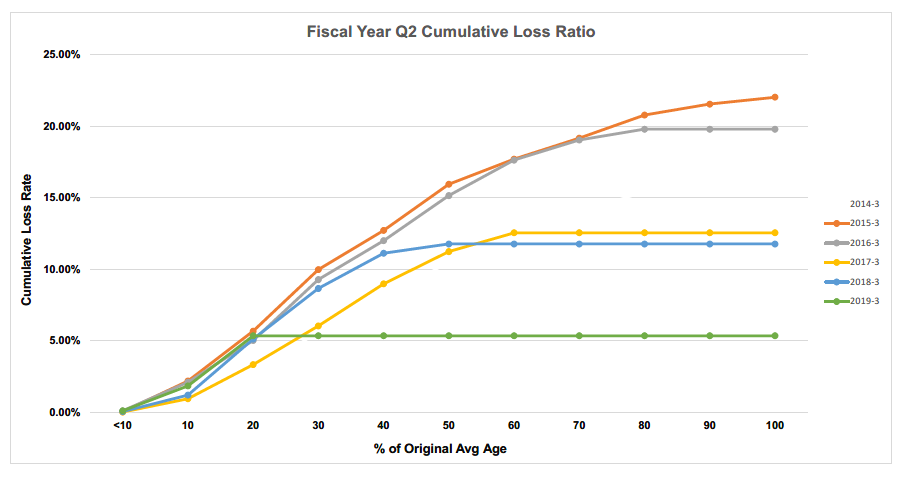

The improved KPI’s combined with our disciplined underwriting and verification processes have combined to improve the performance of our purchases from January 2018 forward, as compared to previous years. The charts below show the quarterly performance of FY 18 Q4 through current quarter by way of loss timing curves. They exemplify our progress when we returned to a more disciplined and conservative approach in January 2018. Our originations beginning at the end of fiscal 2018 and continuing through fiscal years 2019 and 2020 are experiencing lower losses per quarter than each of the previous three years at the same aging point.

Cumulative Loan Loss Ratio Timing Curves by Quarter

One of the key initiatives in fiscal year 2020 was to proliferate our Direct Loan product to as many of our markets as possible. We became fully licensed for the origination of direct consumer loans and the selling of credit-related insurance products in all states serviced by our branch locations, except for Pennsylvania. The result has been a material percentage increase in our direct loan production and a growing impact from that product on our income statement.

Since the vast majority of our direct loans consist of current or former Nicholas borrowers in good standing, we are able to enjoy higher customer retention rates with reduced customer acquisition cost. We also are enjoying dramatically reduced delinquency and losses on this portfolio as compared to our indirect portfolio.

In addition to increasing production from our local branch markets on both the indirect sales finance and direct loan fronts, we set out to expand our presence in new markets by the end of fiscal year 2020. We were able to initiate entrance into Columbia, South Carolina, Milwaukee, Wisconsin, Wichita, Kansas and Las Vegas, Nevada by the conclusion of the fiscal year.

Much of those expansion efforts were put on hold towards the end of the year due to the Covid-19 pandemic, but we have resumed those operations in June. In fact, we have added Salt Lake City, Utah and Boise, Idaho to the mix. As we continue to improve our presence in these markets and build receivables, we will look to establish physical brick and mortar branch offices in these cities.

Nicholas Financial Branch Locations & Expansion Markets

The final piece of our four-pronged approach to growth was our openness to portfolio acquisitions. We began the year announcing the acquisition of all material assets and certain specific liabilities of Metrolina Credit Company. This acquisition added approximately $22.5 MM in receivables to our portfolio (mostly in North and South Carolina). A little over a year later we can look back and confidently confirm this was a very good deal for Nicholas that not only contributed to our profitability, but also helped improve other aspects of our operations. We were able to achieve cost savings by way of office consolidations, retain some quality personnel talent in our combined operations, expand our dealer base in most markets, and reduce the amount of direct competition all in one transaction.

We followed up the Metrolina transaction with a series of bulk acquisitions between December 2019 and February 2020 – resulting in approximately $22 MM in total portfolio acquisitions from Platinum Auto Finance. Once again, by adding seasoned receivables with a proven pay history and the protection of limited recourse, we were able to add to our portfolio more quickly than we could through core originations alone – all the while mitigating the risk of default and loss.

Although we remain committed to our core business of indirect retail sales financing for the subprime buyer of used vehicles as well as the expansion of our direct loan product, we are also very open to exploring and even pursuing quality portfolio acquisitions that align well with our customer base and operations.

Fiscal year 2020 is now behind us. We have celebrated our success and our victories, learned from our challenges and setbacks, and now eagerly look forward to the years ahead of us. Armed with an extremely solid liquidity position, we have the strength to face and survive many challenges and obstacles. Equipped with excellent access to capital through our credit facility, we have the ability to maximize our share in existing and new markets, as well as to act quickly as new opportunities present themselves. Blessed with some of the best and most talented individuals both in the field and in our corporate office, we have the team in place to execute on our strategy today and for years to come. It will never be perfect, and it will surely never be easy, but we have once again tasted some modest success and are hungry for much, much more.

On behalf of our Board of Directors, our management team and each of our hardworking and dedicated employees I say, “Thank You!” Thank you to all of you who have invested in Nicholas. We appreciate your continued belief in our Company. We are sincerely grateful for your confidence, support and trust.

Doug Marohn

President & Chief Executive Officer

July, 2020